Navigating February 2026 RBI Bank Holidays: Your Essential Guide from the USA

Are you a US-based individual or business with financial ties to India? Perhaps you’re sending money to family, managing business payments, or simply planning a trip. If so, knowing the Reserve Bank of India (RBI) bank holidays for February 2026 isn’t just a nicety—it’s a necessity. Unlike the consolidated federal holidays you might be used to in the US, India’s bank holiday schedule can be a bit more nuanced, varying by state and encompassing a mix of national, regional, and festival-specific closures.

Table of Contents

- Navigating February 2026 RBI Bank Holidays: Your Essential Guide from the USA

- February 2026 RBI Bank Holidays at a Glance: The Core Dates You Need

- Understanding the RBI’s Role in Indian Bank Holidays: Why It Matters Globally

- Decoding the Types of Bank Holidays in India

- Practical Implications for US Individuals and Businesses During February 2026

- Key February 2026 Bank Holidays Explained (and Their Significance)

- Second Saturday & Fourth Saturday

- Maha Shivaratri (February 15, 2026)

- Losar (Tibetan New Year – February 2, 2026)

- How to Stay Ahead: Proactive Planning for Indian Bank Holidays

This guide cuts through the complexity, providing you with a clear, concise overview of what to expect in February 2026. We’ll detail the specific dates, explain the types of holidays, and, most importantly, arm you with practical strategies to ensure your financial transactions between the US and India remain smooth and uninterrupted.

February 2026 RBI Bank Holidays at a Glance: The Core Dates You Need

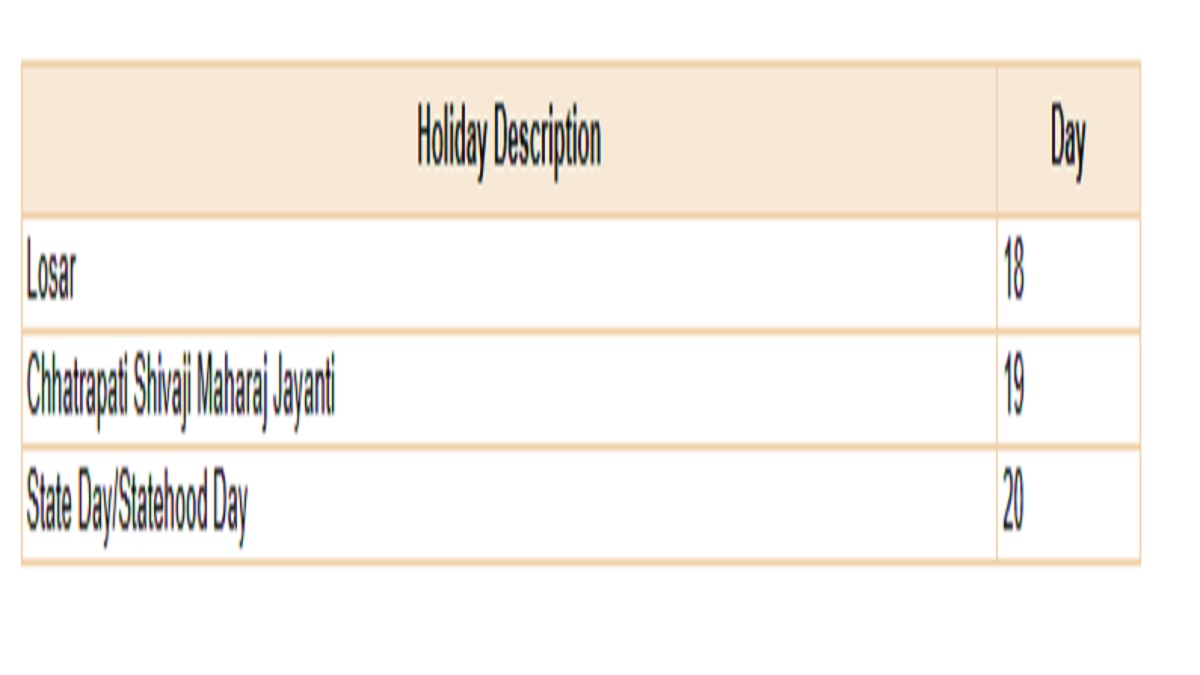

Let’s get straight to what you’re looking for: the definitive list of bank holidays observed across India in February 2026. While some holidays are universally recognized, many are state-specific, meaning a bank might be closed in one region but open in another. This table consolidates the known closures, helping you plan effectively.

| Date | Day | Holiday | Type of Holiday | States/Regions Observed |

|---|---|---|---|---|

| February 2, 2026 | Monday | Losar (Tibetan New Year) | State-Specific | Sikkim, Ladakh |

| February 8, 2026 | Sunday | Weekly Off | All India | All States |

| February 14, 2026 | Saturday | Second Saturday | All India | All States |

| February 15, 2026 | Sunday | Weekly Off / Maha Shivaratri | All India / State-Specific | All States / Certain States for Shivaratri |

| February 22, 2026 | Sunday | Weekly Off | All India | All States |

| February 28, 2026 | Saturday | Fourth Saturday | All India | All States |

Note on Maha Shivaratri: According to several sources, Maha Shivaratri falls on Sunday, February 15, 2026. While a significant religious festival, its observance on a Sunday means that it typically aligns with a regular weekly bank holiday and does not result in an additional closure of banks on a working day. However, specific state governments might declare an additional holiday on the Monday following, but this is less common for festivals falling on weekends. Always confirm with the local bank branch if your transaction is time-sensitive.

For US residents, understanding these dates is crucial. It means planning your remittances, business payments, or even just checking your account balances will need to factor in potential delays on these specific days, especially if your transactions require manual processing or interbank communication within India.

Understanding the RBI’s Role in Indian Bank Holidays: Why It Matters Globally

When we talk about bank holidays in India, the Reserve Bank of India (RBI) is the central authority. Think of the RBI as India’s version of the US Federal Reserve—it’s the central bank responsible for maintaining financial stability, regulating banks, issuing currency, and, yes, announcing official bank holidays. For anyone dealing with Indian finances from abroad, understanding the RBI’s role is foundational.

The RBI categorizes holidays under three main headings:

- The Negotiable Instruments Act, 1881: This is the primary act under which the RBI declares holidays. If a day is declared a holiday under this act, all financial institutions, including public and private sector banks, are typically closed for public transactions. This includes cheque clearing, direct debit transactions, and other paper-based instruments.

- The Negotiable Instruments Act (Holiday for Real Time Gross Settlement – RTGS): This specifically addresses holidays for the Real-Time Gross Settlement (RTGS) system, which facilitates large-value interbank transactions. While banks might be physically open, the RTGS system might not be operational.

- Banks’ Closing of Accounts: This is usually a single day (April 1st) when banks close their books for the financial year. While this isn’t relevant for February 2026, it’s an important distinction to know for other times of the year.

Why does this matter for you, living in the US? Because these closures directly impact the speed and availability of services for any funds you’re sending to or receiving from India. A bank holiday means no processing of transactions, no customer service, and essentially, a pause in the financial system. For international transfers, this can add an extra day or two to processing times, which could be critical for urgent payments.

Decoding the Types of Bank Holidays in India

India’s diverse cultural and geographical landscape means its holiday calendar is equally varied. Understanding these categories will help you interpret the February 2026 schedule more accurately:

- National Holidays: These are observed uniformly across all banks in India. There are only three true national holidays: Republic Day (January 26), Independence Day (August 15), and Mahatma Gandhi’s Birthday (October 2). While none fall in February, it’s good to know these are the only days when you can be certain all Indian banks will be closed, irrespective of state.

- State-Specific Holidays: This is where it gets interesting and requires closer attention. India is divided into numerous states, each with its own unique festivals, traditions, and official holidays. The RBI provides a general list, but individual state governments often declare additional holidays specific to their region. For example, festivals like Losar (Tibetan New Year) or other regional observances will only close banks in certain states, not nationwide. This means a bank in Mumbai could be open while a branch in Sikkim is closed on the same day.

- Weekend Holidays (Second and Fourth Saturdays & Sundays): This is a standard and predictable part of the Indian banking calendar. Since 2015, all public and private sector banks in India observe holidays on the second and fourth Saturdays of every month, in addition to all Sundays. These are essentially non-working days for banks. For February 2026, these include February 8th (Sunday), February 14th (Second Saturday), February 15th (Sunday), February 22nd (Sunday), and February 28th (Fourth Saturday).

- RTGS/NEFT Holidays: While banks generally operate on weekdays, electronic transfer systems like National Electronic Funds Transfer (NEFT) and RTGS might have specific holiday schedules. However, it’s worth noting that NEFT has been made available 24×7, 365 days a year, since December 2019. RTGS also became 24×7 from December 2020. This significantly reduces the impact of standard bank holidays on electronic transfers, though underlying bank operations for processing specific requests (like international wires that need manual review) can still be affected.

For US residents, the key takeaway is that you can’t assume a holiday in one part of India applies everywhere. Always check the specific state relevant to your transaction.

Practical Implications for US Individuals and Businesses During February 2026

Understanding the RBI’s holiday schedule is more than just academic; it has tangible impacts on anyone in the US dealing with Indian financial institutions. Here’s what you need to consider:

- Remittances and Fund Transfers: If you’re sending money to family or friends in India, expect potential delays if the transfer coincides with a bank holiday. While digital platforms and NEFT/RTGS operate 24/7, the final credit to the beneficiary’s account or cash pickup might be delayed until the next working day if the recipient’s bank branch is closed. Plan to initiate transfers a day or two in advance of critical dates, especially around the Second and Fourth Saturdays and Sundays, or any specific state holidays if your recipient is in one of those regions.

- Business Transactions and Payments: For US businesses that import from, export to, or have operations in India, bank holidays can impact your cash flow and operational timelines. Payments to suppliers, salary disbursements, or settlement of invoices might be postponed. This can affect supply chain logistics, contract deadlines, and even your working capital. Always factor in these non-working days when setting payment schedules or project milestones with your Indian counterparts.

- Customer Service and Banking Operations: Need to speak with a bank representative in India, resolve an issue, or process a specific request that requires human intervention? Bank holidays mean reduced or no customer service availability. Online banking portals and mobile apps will still function for basic inquiries and self-service transactions, but anything requiring a bank employee will have to wait.

- Planning Your Travel to India: If you’re planning a trip to India in February 2026, be mindful of these holidays. While you might not be directly conducting large financial transactions, ATMs could run low on cash in smaller towns, and exchanging currency might be difficult on these days. It’s always wise to carry enough local currency or have alternative payment methods available.

- Impact on Stock Markets and Financial Markets: While not directly affecting your bank transfers, it’s worth noting that stock exchanges (like NSE and BSE) and other financial markets in India also observe these holidays, which can affect trading and investment activities.

The key here is foresight. Proactive planning can mitigate most of the inconveniences caused by these scheduled closures.

Key February 2026 Bank Holidays Explained (and Their Significance)

Let’s take a closer look at some of the specific holidays listed for February 2026 and what they entail, particularly for a US audience:

Second Saturday & Fourth Saturday

These are predictable, recurring non-working days for banks across India. Prior to 2015, banks in India typically operated on all Saturdays. However, following an agreement between bank employee unions and the Indian Banks’ Association, it was decided that the second and fourth Saturdays of every month would be holidays. This means that for four days out of every month (the two Saturdays and all Sundays), banks are closed for routine business. For February 2026, these fall on the 14th and 28th.

Maha Shivaratri (February 15, 2026)

Maha Shivaratri is one of the most significant and revered festivals in Hinduism, celebrated with immense devotion across India. It honors Lord Shiva, commemorating the overcoming of darkness and ignorance in life and the spiritual awakening. Devotees observe fasts, perform pujas, and offer prayers in temples throughout the night. It is typically a state-specific bank holiday in several states, particularly in central and northern India where the observance is strong.

However, for February 2026, Maha Shivaratri falls on a Sunday, February 15th. Since Sundays are already weekly bank holidays across India, this means the festival’s observance does not result in an *additional* non-working day for banks in February. While its cultural and religious significance remains paramount, its impact on bank closures for February 2026 is minimal for this reason. Nonetheless, it’s a good example of how deeply interwoven cultural and religious festivals are with the public holiday calendar in India.

Losar (Tibetan New Year – February 2, 2026)

Losar is the Tibetan New Year, a vibrant and significant festival primarily celebrated by the Buddhist community. It’s marked by elaborate rituals, prayers, traditional dances, and family gatherings. While not a national holiday, it is a declared state holiday in regions with a significant Tibetan and Buddhist population, most notably Sikkim and Ladakh. For anyone conducting transactions involving banks in these specific regions, February 2nd, 2026, will be a non-banking day.

These examples illustrate the blend of regular weekend closures and culturally specific holidays that characterize India’s banking calendar. Always verify the exact location of your financial interaction.

How to Stay Ahead: Proactive Planning for Indian Bank Holidays

Navigating international banking requires a strategic approach. Here’s how US individuals and businesses can proactively manage their financial interactions with India during February 2026 and beyond:

- Verify with Official Sources: While we’ve provided a comprehensive guide, the most accurate information will always come directly from the RBI or reputable financial news outlets in India. For critical transactions, cross-reference the information.

- Communicate with Your Indian Contacts: Whether it’s a business partner, a vendor, or family members, ensure they are aware of upcoming holidays. They can provide local insights and help you schedule transactions around non-working days.

- Utilize Digital Banking Tools: Online banking portals and mobile apps allow you to initiate transfers, check balances, and manage accounts 24/7. While processing may still be delayed on holidays, you can prepare transactions ahead of time.

- Plan International Transfers in Advance: This is the golden rule. For any time-sensitive remittance or business payment, aim to initiate it several days before an anticipated bank holiday. This buffer allows for any unforeseen delays. Consider setting up recurring payments well in advance to avoid last-minute rushes.

- Understand Cut-Off Times: Even on regular working days, international transfers often have daily cut-off times. Missing these can push your transaction to the next business day, which compounds the impact if a holiday follows.

- Consider Alternative Payment Methods: For smaller, non-urgent transfers, explore alternative payment services that might have different operational schedules or fewer direct ties to traditional bank holiday closures. However, always exercise due diligence regarding fees and exchange rates.

- Set Up Alerts and Notifications: Many banking apps and money transfer services offer notifications for transaction status. Enable these to stay informed about your payment’s progress, especially during periods with holidays.

By adopting these proactive strategies, you can minimize disruptions and ensure your financial flow between the US and India remains as smooth as possible, even with the unique challenges posed by India’s diverse bank holiday schedule.

Frequently Asked Questions

What is the Reserve Bank of India (RBI)?

The Reserve Bank of India (RBI) is India’s central bank, similar to the US Federal Reserve. It’s responsible for regulating the Indian banking system, issuing currency, managing monetary policy, and announcing official bank holidays that affect all financial institutions in the country.

How do RBI bank holidays affect people in the USA?

For individuals and businesses in the USA, RBI bank holidays primarily affect the processing and settlement of financial transactions with India. This includes remittances, business payments, and other cross-border transfers. Transactions initiated on or around these days may experience delays, impacting liquidity and planning.

Are all bank holidays in India national?

No, not all bank holidays in India are national. Only three holidays are uniformly observed across all Indian states: Republic Day (Jan 26), Independence Day (Aug 15), and Mahatma Gandhi’s Birthday (Oct 2). Many other holidays are state-specific, meaning banks are closed only in particular regions due to local festivals or observances, while remaining open elsewhere.

What happens if I initiate a transaction on an Indian bank holiday?

If you initiate a transaction (like a wire transfer or payment) on an Indian bank holiday, it will likely not be processed until the next working day. While digital platforms might allow you to submit the transaction, its actual execution, clearance, and credit to the beneficiary’s account will be paused until banks resume operations. Always plan for extra processing time.

How can I confirm the official RBI bank holidays for February 2026?

For the most accurate and up-to-date information, you should refer to the official Reserve Bank of India website. Additionally, reputable Indian financial news sources and the websites of major Indian banks often publish their holiday schedules. When checking, pay close attention to state-specific variations.

Does the RBI announce holidays for all banks, including private ones?

Yes, the holidays announced by the RBI under the Negotiable Instruments Act, 1881, apply to both public sector and private sector banks across India. This ensures uniformity in banking operations during declared holidays.

What are RTGS/NEFT holidays?

RTGS (Real-Time Gross Settlement) and NEFT (National Electronic Funds Transfer) are electronic payment systems in India. While historically they had specific holiday schedules, both systems now operate 24×7, 365 days a year. This means the electronic transfer mechanism itself is available, though the ultimate credit to an account or any associated manual bank processing might still be impacted by physical bank closures on holidays.