February 2026 Bank Holidays in India: Your Essential Guide for Planning from the USA

Are you in the USA, managing finances or planning travel involving India in February 2026? Whether you’re sending remittances to family, handling business transactions, or coordinating a trip, understanding India’s bank holiday schedule is crucial. Missing a critical date could delay transfers, impact business operations, or simply leave you frustrated.

Table of Contents

- February 2026 Bank Holidays in India: Your Essential Guide for Planning from the USA

- Understanding India’s Bank Holiday System

- National Holidays: Universal Closures

- State-Specific Holidays: Regional & Cultural Significance

- Weekend Holidays: Second and Fourth Saturdays, and All Sundays

- Complete List of February 2026 Bank Holidays in India

- Core Weekend Closures in February 2026

- State-Specific Festival & Observance Holidays in February 2026

- Detailed Breakdown: February 2026 State-Specific Bank Holidays (By Date)

- Losar (Tibetan New Year) – February 18, 2026 (Wednesday)

- Chhatrapati Shivaji Maharaj Jayanti – February 19, 2026 (Thursday)

- Impact on Banking Services: What You Need to Know (from the USA)

- International Remittances and Transfers: NEFT, RTGS, IMPS

- Online Banking and ATMs: Your Always-On Access

- Business Transactions: Planning Around Closures

- Pro Tips for Seamless Financial Planning in India (from Afar)

- Navigating Future Bank Holidays in India

Forget the generic lists. This isn’t just a calendar; it’s your definitive guide to navigating Indian bank holidays in February 2026, specifically tailored for those of us operating from across the globe. We’ll break down the types of holidays, provide a clear, easy-to-read schedule, and equip you with actionable strategies to ensure your financial dealings run smoothly, no matter the closures.

Let’s cut through the confusion and get you prepared!

Understanding India’s Bank Holiday System

India’s approach to bank holidays is a little different from what you might be used to in the USA. It’s not just about a few national days off. The system is a rich tapestry woven with national observances, deeply regional cultural festivals, and standard weekend closures. For anyone in the USA dealing with Indian banks, this multi-layered system can be a challenge without the right information.

The Reserve Bank of India (RBI), the country’s central banking institution, sets the framework for these holidays. They issue guidelines and often publish lists for the year, which individual banks then adhere to. This ensures a standardized approach, but remember, state governments also play a significant role in declaring regional holidays.

Essentially, bank holidays in India fall into three main categories:

National Holidays: Universal Closures

These are the big ones. Observed across the entire country, banks are universally closed on these days. Examples include Republic Day (January 26th), Independence Day (August 15th), and Mahatma Gandhi’s Birthday (October 2nd). While February 2026 doesn’t feature a national holiday, it’s vital to know these exist for your broader annual planning.

State-Specific Holidays: Regional & Cultural Significance

This is where it gets interesting and often complex for international users. India’s diverse culture means that various states celebrate different festivals and observances. A bank might be open in Delhi but closed in Mumbai, or vice-versa, depending on the local holiday calendar. These holidays are declared by the respective state governments under the Negotiable Instruments Act.

Weekend Holidays: Second and Fourth Saturdays, and All Sundays

This is a critical distinction. Unlike many countries where banks are only closed on Sundays, Indian banks also observe the second and fourth Saturdays of every month as holidays. This means every month has at least four weekend bank holidays (all Sundays + two Saturdays), and often six (all Sundays + two specific Saturdays). This alone can significantly impact your transaction timelines if you’re not aware.

Complete List of February 2026 Bank Holidays in India

Let’s get straight to the dates that matter for February 2026. This comprehensive list covers both the standard weekend closures and any specific festival or observance holidays declared for the month. Remember, this information is compiled from official sources and projections based on typical Indian holiday patterns.

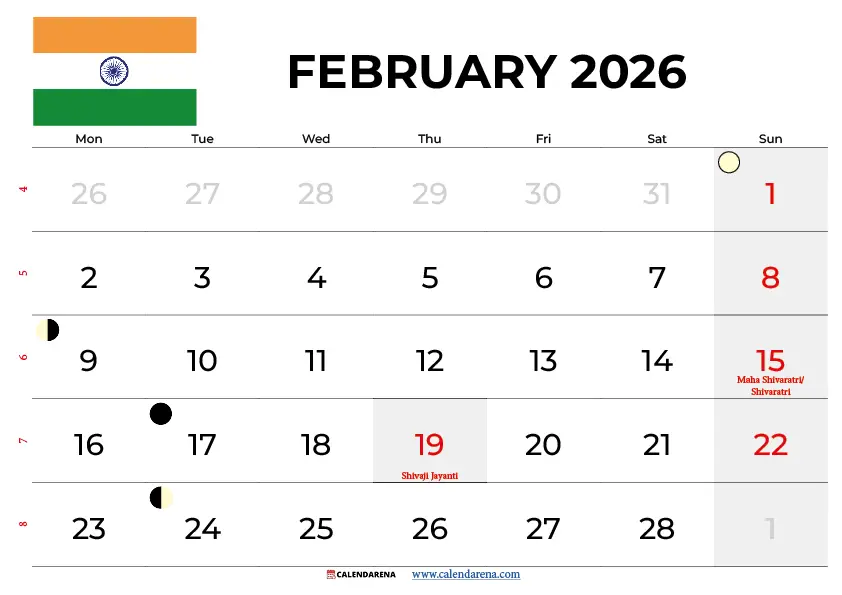

Core Weekend Closures in February 2026

These are the fixed days when banks across India will be closed due to weekend policies. Plan any time-sensitive transactions accordingly, especially if you’re aiming for a Friday or Monday around these dates.

| Date | Day | Holiday Type | Remarks |

|---|---|---|---|

| February 1, 2026 | Sunday | Weekend Holiday | Regular Weekly Off |

| February 8, 2026 | Sunday | Weekend Holiday | Regular Weekly Off |

| February 14, 2026 | Saturday | Weekend Holiday | Second Saturday – All banks closed |

| February 15, 2026 | Sunday | Weekend Holiday | Regular Weekly Off |

| February 22, 2026 | Sunday | Weekend Holiday | Regular Weekly Off |

| February 28, 2026 | Saturday | Weekend Holiday | Fourth Saturday – All banks closed |

State-Specific Festival & Observance Holidays in February 2026

Beyond the fixed weekend closures, February 2026 also brings a couple of significant regional holidays that will affect banking services in specific Indian states. If your transactions involve these regions, take note!

| Date | Day | Holiday Name | States/Regions Observed | Significance |

|---|---|---|---|---|

| February 18, 2026 | Wednesday | Losar | Sikkim (especially Gangtok) | Tibetan New Year, a significant festival for the Buddhist community. |

| February 19, 2026 | Thursday | Chhatrapati Shivaji Maharaj Jayanti | Maharashtra | Birthday of the founder of the Maratha Empire, a revered historical figure in Maharashtra. |

Detailed Breakdown: February 2026 State-Specific Bank Holidays (By Date)

Let’s dive a little deeper into the specific regional holidays to give you the full picture, especially if your financial activities or travel plans take you to these areas.

Losar (Tibetan New Year) – February 18, 2026 (Wednesday)

Losar is a vibrant and culturally rich festival marking the Tibetan New Year. It’s a time of joyous celebrations, prayers, and traditional gatherings for the Buddhist communities. In India, its observance is particularly prominent in states with a significant Tibetan population or influence, most notably Sikkim. If you’re planning any financial dealings or travel to Gangtok or other parts of Sikkim on this day, expect banks and many businesses to be closed. This holiday reflects the rich tapestry of cultures within India, where regional beliefs and traditions lead to specific public holidays.

Chhatrapati Shivaji Maharaj Jayanti – February 19, 2026 (Thursday)

This day commemorates the birth of Chhatrapati Shivaji Maharaj, a legendary Maratha ruler and one of the most revered figures in Indian history, especially in the state of Maharashtra. Shivaji is celebrated for his valiant resistance against the Mughal Empire and for establishing a just and efficient administration. His birth anniversary is a significant state holiday in Maharashtra, observed with great enthusiasm. Banks, government offices, and many businesses across Maharashtra will remain closed on this day. If your financial transactions involve cities like Mumbai, Pune, or Nagpur, be sure to factor in this closure.

Impact on Banking Services: What You Need to Know (from the USA)

So, you’ve got the dates. Now, how do these closures actually affect your banking from thousands of miles away?

International Remittances and Transfers: NEFT, RTGS, IMPS

This is perhaps the most critical area for individuals and businesses in the USA. While India has advanced digital payment systems, their processing often relies on banks being open:

- NEFT (National Electronic Funds Transfer): This system processes transactions in batches. While NEFT is available 24/7, 365 days a year, the *settlement of funds can be delayed if the beneficiary bank is closed on a holiday. Your transfer might be initiated, but the recipient might not see the funds until the next working day.

- RTGS (Real Time Gross Settlement): Designed for large-value transactions, RTGS is also available 24/7. However, similar to NEFT, final credit to the beneficiary’s account could be impacted by a bank holiday, especially if it’s a state-specific closure for the recipient’s bank.

- IMPS (Immediate Payment Service): This is the fastest method, available instantly. IMPS transactions are generally less affected by bank holidays for inter-bank* transfers within India, as the system is automated. However, if you’re initiating an IMPS transfer from an international service that then routes through an Indian bank’s holiday-affected internal system, there could still be delays.

The bottom line for international transfers: Always factor in an extra business day (or two, if you’re being cautious) around Indian bank holidays, especially if the transaction is time-sensitive or involves a specific state where a holiday is observed. Weekends and specific holidays can effectively create a longer ‘banking weekend’.

Online Banking and ATMs: Your Always-On Access

Good news here! While physical bank branches will be closed, your digital access remains largely unaffected:

- Online and Mobile Banking Portals: You can still access your accounts, view statements, pay bills (if the payment gateway itself is operational), and initiate transfers via your bank’s website or app. Just be mindful that internal processing and final settlement might only occur on the next working day.

- ATMs (Automated Teller Machines): ATMs are generally operational 24/7, allowing for cash withdrawals, deposits, and other basic banking services. However, during extended holiday periods, cash replenishment might be slower, so plan your cash needs accordingly if you or your contacts in India anticipate a longer break.

Business Transactions: Planning Around Closures

For businesses in the USA with operations, partners, or employees in India, these holidays are critical for:

- Payroll: Ensure salaries are disbursed well in advance of bank holidays to avoid delays.

- Vendor Payments: Schedule payments to Indian vendors or suppliers to account for potential processing lags.

- Invoice Collections: If you’re expecting payments from Indian clients, understand that bank closures might impact their ability to process and send funds.

- Contract Deadlines: Be aware that banking holidays can affect the availability of funds or services critical to meeting contractual obligations.

Pro Tips for Seamless Financial Planning in India (from Afar)

Knowledge is power, especially when you’re managing cross-border finances. Here are some actionable tips to ensure February 2026, and indeed any month, runs smoothly for your Indian banking needs:

- Plan Ahead: This is the golden rule. If you know a payment needs to hit an Indian account by a certain date, initiate it at least 2-3 business days in advance, especially around the second/fourth Saturdays or any regional holidays. Think of the entire weekend as a ‘blackout period’ for immediate settlements.

- Utilize Digital Channels: Embrace online banking, mobile apps, and digital transfer services. While final settlement may wait for a working day, you can initiate most transactions anytime, anywhere. This reduces the dependency on physical branch timings.

- Confirm with Your Bank: If you have a critical, high-value transaction, don’t hesitate to reach out to your specific Indian bank (or the international transfer service you use) to confirm their holiday schedule and processing times. Bank websites typically have dedicated holiday calendars.

- Consider Buffer Time: For truly critical payments like loan EMIs, rent, or urgent business payments, always build in a buffer of an extra day or two. It’s better to be early than to face late payment penalties or operational disruptions.

- Know Your States: Understand which Indian states your recipients or business partners are located in. A holiday in Maharashtra won’t affect a transfer to Tamil Nadu, but it absolutely will impact Mumbai.

Navigating Future Bank Holidays in India

February 2026 is just one month. The pattern of national, state-specific, and weekend holidays repeats throughout the year. For NRIs, international businesses, and frequent travelers:

- Regularly Check Official Sources: Keep an eye on the Reserve Bank of India (RBI) website and major Indian financial news outlets for annual holiday declarations.

- Subscribe to Updates: Many banks and financial service providers offer email or app notifications for upcoming holidays.

- Maintain a Calendar: Integrate Indian bank holidays into your personal or business planning calendar.

By understanding the nuances of India’s banking holidays, you can avoid unnecessary stress and ensure your financial interactions with India are always timely and efficient. Stay informed, plan smartly, and keep those transactions flowing!

Frequently Asked Questions

Are all Indian banks closed on February 2026 holidays?

Not necessarily all. Banks are universally closed on National Holidays and the second/fourth Saturdays and all Sundays. However, specific festival holidays (like Losar or Chhatrapati Shivaji Maharaj Jayanti) are observed only in the states or regions where they are declared, meaning banks in other states will remain open.

How do these holidays affect online transfers (NEFT/RTGS) from the USA?

While NEFT and RTGS are available 24/7 for initiation, the final credit and settlement of funds to the beneficiary’s account in India can be delayed until the next working day if the receiving bank branch is closed due to a holiday (national, state-specific, or weekend). It’s always best to plan transfers with an extra buffer day.

Are ATMs operational during bank holidays in India?

Yes, ATMs are generally operational 24/7 during bank holidays, allowing for cash withdrawals and basic transactions. However, during extended holiday periods, cash replenishment might be slower, so it’s advisable to plan for cash needs in advance.

What is the difference between a National, State, and Weekend bank holiday in India?

National Holidays (e.g., Republic Day) are observed across all states. State-Specific Holidays (e.g., Losar in Sikkim) are observed only in particular states or regions. Weekend Holidays include all Sundays and the second and fourth Saturdays of every month, which are observed by all banks nationwide.

Where can I find the official list of bank holidays for India?

The most authoritative source is the Reserve Bank of India (RBI) website, which often publishes the annual holiday list. Individual bank websites also provide their specific holiday calendars, which incorporate both RBI guidelines and state-specific declarations.

Can I use mobile banking during bank holidays?

Yes, mobile banking and internet banking portals remain fully accessible during bank holidays. You can view balances, initiate transfers, and pay bills. However, similar to NEFT/RTGS, the actual processing and settlement of some transactions that require manual intervention or inter-bank clearing may be delayed until the next business day.

Why is it important for someone in the USA to know about Indian bank holidays?

It’s crucial for managing international remittances, ensuring timely business payments to Indian partners or employees, and planning travel to avoid cash shortages or disrupted banking services. Being aware helps prevent delays, penalties, and ensures smooth financial operations across borders.