Navigating February 2026 Bank Holidays in India: Your Essential Guide for Global Planning

Are you in the USA but have financial ties, business dealings, or travel plans involving India? Then understanding India’s bank holiday schedule is absolutely critical. Imagine sending a time-sensitive payment, only for it to be delayed by days because you weren’t aware of a regional bank closure. Frustrating, right?

Table of Contents

- Navigating February 2026 Bank Holidays in India: Your Essential Guide for Global Planning

- Quick Overview: February 2026 Bank Holidays India

- Understanding India’s Bank Holiday System: Not All Closures Are Created Equal

- The RBI’s Role: Mandating Closures for National Harmony

- State-Specific Holidays: A Tapestry of Local Traditions

- Weekend Routines: The 2nd and 4th Saturday Rule

- Public vs. Private Banks: Are the Rules Different?

- Detailed Breakdown: February 2026 Bank Holidays Across India

- What Do Indian Bank Holidays Mean for You in the USA?

- International Money Transfers & Remittances (NEFT/RTGS/IMPS)

- Business Operations and Deadlines

- Travel Planning: Navigating Local Services

- Investment and Stock Market Implications

- Planning Ahead: Strategies to Navigate Indian Bank Holidays

- Check Official Sources Regularly

- Utilize Digital Banking (But Be Aware of Limitations)

- Factor in Buffer Time for Critical Transactions

- Communicate with Indian Counterparts

- Beyond February 2026: Staying Informed Year-Round

This guide cuts through the confusion, providing you with the definitive breakdown of February 2026 bank holidays in India. We’ll not only list the dates but also explain their significance, especially for those of us managing international transactions, business operations, or planning a trip.

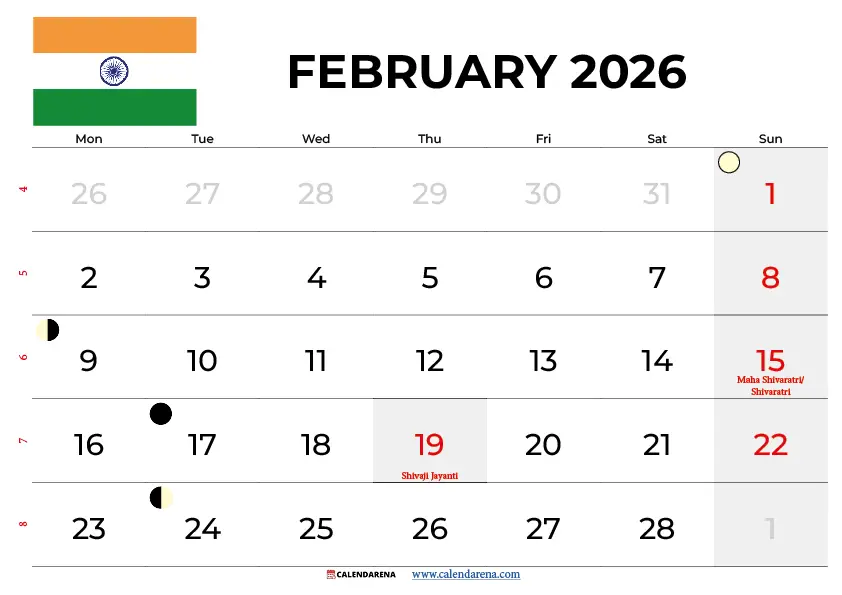

Quick Overview: February 2026 Bank Holidays India

Let’s get straight to the point. February 2026, like any other month, will see several bank closures across India. These include standard weekend holidays (Sundays, 2nd, and 4th Saturdays) and potentially a few regional festival-specific closures. Here’s a snapshot of the guaranteed non-working days for banks:

| Date | Day | Holiday Type | Impact |

|---|---|---|---|

| February 1, 2026 | Sunday | Weekly Holiday | Banks closed nationwide |

| February 8, 2026 | Sunday | Weekly Holiday | Banks closed nationwide |

| February 14, 2026 | Saturday | 2nd Saturday | Banks closed nationwide |

| February 15, 2026 | Sunday | Weekly Holiday | Banks closed nationwide |

| February 22, 2026 | Sunday | Weekly Holiday | Banks closed nationwide |

| February 28, 2026 | Saturday | 4th Saturday | Banks closed nationwide |

Important Note: This table covers the standard, nationwide closures. India’s diverse culture means additional state-specific holidays might apply. Keep reading for a more detailed breakdown.

Understanding India’s Bank Holiday System: Not All Closures Are Created Equal

When you’re dealing with banking in India, it’s crucial to understand the different layers of holidays. It’s not just a single list that applies everywhere. This complexity is often the source of confusion for international clients.

The RBI’s Role: Mandating Closures for National Harmony

The Reserve Bank of India (RBI) is the central banking institution of India. They issue official lists of bank holidays under three main categories:

- Negotiable Instruments Act Holidays: These are typically national holidays and major festivals, observed by banks across the entire country.

- Real-Time Gross Settlement (RTGS) Holidays: Days when RTGS services (large-value interbank funds transfers) are unavailable.

- Closing of Accounts: Usually on April 1st, for the annual closing of bank accounts.

When the RBI declares a holiday under the Negotiable Instruments Act, you can pretty much guarantee that all public and private sector banks in the specified regions will be closed.

State-Specific Holidays: A Tapestry of Local Traditions

This is where it gets interesting! Beyond the national holidays, individual state governments have the authority to declare their own public holidays based on local festivals, anniversaries, or significant regional events. For instance, a holiday celebrated in Kerala might not be observed in Uttar Pradesh, and vice-versa.

This means that while the general overview gives you a good start, if your transaction involves a specific Indian state, you need to check its particular holiday calendar for February 2026. This is a common pitfall for international businesses and individuals.

Weekend Routines: The 2nd and 4th Saturday Rule

Since 2015, a significant change in Indian banking meant that all public and private sector banks remain closed on the 2nd and 4th Saturdays of every month. All Sundays are also bank holidays. This is a crucial detail, as it adds two more fixed non-working days each month beyond the standard Sunday closures.

Public vs. Private Banks: Are the Rules Different?

Generally, no. When a bank holiday is declared, it applies to both public sector banks (like State Bank of India, Punjab National Bank) and private sector banks (like HDFC Bank, ICICI Bank, Axis Bank). So, you don’t need to worry about different rules for different bank types regarding these official closures.

Detailed Breakdown: February 2026 Bank Holidays Across India

Let’s dive into the specifics for February 2026. While definitive state-specific notifications for 2026 are still some time away, we can anticipate common regional holidays that often fall in February, in addition to the mandatory weekend closures. Always cross-reference with official RBI and state government websites closer to the date.

Here’s a comprehensive table including anticipated regional holidays based on historical patterns:

| Date | Day | Holiday Name | Applicable States/Regions (Likely) | Reason/Significance |

|---|---|---|---|---|

| February 1, 2026 | Sunday | Weekly Holiday | All India | Standard weekend bank closure |

| February 8, 2026 | Sunday | Weekly Holiday | All India | Standard weekend bank closure |

| February 14, 2026 | Saturday | 2nd Saturday | All India | Mandatory bank closure |

| February 15, 2026 | Sunday | Weekly Holiday | All India | Standard weekend bank closure |

| February 18, 2026 | Wednesday | Losar (Tibetan New Year) | Sikkim (potentially other Himalayan regions) | Important Buddhist festival, marking the New Year |

| February 19, 2026 | Thursday | Chhatrapati Shivaji Maharaj Jayanti | Maharashtra | Birth anniversary of the great Maratha warrior king |

| February 22, 2026 | Sunday | Weekly Holiday | All India | Standard weekend bank closure |

| February 28, 2026 | Saturday | 4th Saturday | All India | Mandatory bank closure |

Disclaimer: Dates for regional holidays (like Losar, Chhatrapati Shivaji Maharaj Jayanti) are based on their typical occurrence in February and historical patterns. Official declarations by the RBI and respective state governments for 2026 should always be the final source of truth. Always verify closer to the date.

What Do Indian Bank Holidays Mean for You in the USA?

This is the million-dollar question for many of you reading this from across the globe. Indian bank holidays aren’t just local inconveniences; they have tangible impacts on international interactions.

International Money Transfers & Remittances (NEFT/RTGS/IMPS)

If you regularly send money to family in India, pay vendors, or manage payroll for an Indian team, bank holidays can directly affect your transaction times:

- IMPS (Immediate Payment Service) and UPI (Unified Payments Interface) are generally available 24/7, including holidays, for instant transfers between participating banks. However, the recipient bank’s internal processing for crediting the account might still see minor delays if staff are off.

- NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement), while operating 24×7 these days, can still see delays if a specific branch-level intervention or a larger system process is required that depends on human oversight, or if the sending/receiving bank’s backend is heavily impacted. Most importantly, if your initial international transfer hits an Indian bank on a holiday, it might only be processed and credited on the next working day.

- Wire Transfers: International wire transfers often depend on correspondent banking relationships. If an Indian bank branch is closed, receiving funds or processing outgoing wires might be paused until the next working day.

My advice: Always assume an extra business day (or two, if it’s a long weekend) for any transaction hitting India during a holiday period.

Business Operations and Deadlines

For US-based businesses working with Indian partners, suppliers, or employees, bank holidays can impact:

- Vendor Payments: Payment cycles might need adjustment to ensure timely remittance.

- Payroll: If you have employees in India, ensure their salaries are processed in advance to avoid delays around holidays.

- Contractual Obligations: Any deadlines tied to financial transactions should factor in potential bank closures.

- Trade and Commerce: Customs clearances, letter of credit processing, and other trade finance activities can slow down.

Travel Planning: Navigating Local Services

Are you planning a trip to India in February 2026? Bank holidays can affect your travel experience:

- Currency Exchange: Bank branches will be closed, making it impossible to exchange currency there. ATMs will still function, but might run out of cash in popular tourist spots during extended holidays.

- Financial Emergencies: Accessing banking services in person for any unforeseen issues will be difficult.

- General Closures: While not directly bank-related, remember that many businesses, government offices, and even some smaller shops might also observe regional holidays, potentially impacting your travel plans or access to services.

Investment and Stock Market Implications

For investors interested in the Indian market, please note that the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) generally remain closed on the same days as banks for public holidays. So, if you’re planning any trading activity, be aware of these closures.

Planning Ahead: Strategies to Navigate Indian Bank Holidays

Forewarned is forearmed! Here’s how you can proactively manage your affairs despite Indian bank holidays:

Check Official Sources Regularly

The best defense is a good offense. Always refer to the official sources for the most accurate and up-to-date information:

- The Reserve Bank of India (RBI) website for national holiday declarations.

- The official websites of the state governments in question for regional holidays.

- The specific bank’s official website (e.g., HDFC, SBI, ICICI) if you have an account or are transferring to/from them.

These lists are usually finalized and published closer to the year-end preceding the holidays, or sometimes even a month in advance for specific regional ones. So, bookmark this guide and check back or consult official channels as February 2026 approaches.

Utilize Digital Banking (But Be Aware of Limitations)

For domestic transfers within India, IMPS and UPI are often lifesavers on holidays. For international transfers, many online remittance services operate 24/7. However, remember the underlying banking systems. While you can initiate a transfer, the actual processing and crediting to the recipient’s account in India might still pause until the next working day if a manual intervention or a specific clearing process is required. Always confirm the expected delivery time with your service provider.

Factor in Buffer Time for Critical Transactions

This is perhaps the most important piece of advice. If a payment or transaction is time-sensitive, always build in extra buffer days. If you need funds to arrive by a certain date, send them 2-3 business days earlier than you normally would, especially if there’s a holiday around your expected delivery date. This simple step can save you a lot of stress.

Communicate with Indian Counterparts

If you’re dealing with a business partner, client, or even family members in India, a quick heads-up about upcoming holidays can make a big difference. They can inform you of local closures you might have missed or advise on the best timing for transactions.

Beyond February 2026: Staying Informed Year-Round

The principles discussed here apply to every month of the year. India’s holiday calendar is dynamic, reflecting its rich cultural diversity. To stay informed:

- Regularly check the RBI’s official holiday list (published annually).

- Consult reliable financial news portals or dedicated holiday tracking websites for specific states.

- If you have banking apps in India, they often provide in-app notifications or calendars for upcoming holidays.

By adopting these proactive habits, you’ll ensure that India’s bank holidays never catch you off guard, allowing for seamless international financial management and travel planning from the USA.

Frequently Asked Questions

What are the guaranteed bank holidays in India for February 2026?

For February 2026, all banks in India will be closed on Sundays (February 1, 8, 15, 22), and on the 2nd and 4th Saturdays (February 14 and 28). These are nationwide, mandatory closures.

How do state-specific bank holidays affect me if I’m in the USA?

State-specific holidays mean that banks in certain Indian states might be closed even if it’s a regular working day elsewhere in India. If your transaction or travel involves a specific state (e.g., sending money to a bank in Maharashtra, or visiting Sikkim), you need to check that state’s holiday calendar to avoid delays.

Will international money transfers to India be affected by these holidays?

Yes, international money transfers can be affected. While some digital transfer methods like IMPS/UPI are 24/7, the actual processing, crediting, or any required manual intervention by the receiving bank in India might pause during a holiday. It’s best to allow an extra 1-2 business days for funds to clear if they arrive around a bank holiday.

Can I still use ATMs and online banking during bank holidays in India?

Yes, ATMs typically remain operational during bank holidays for cash withdrawals, though popular locations might run low on cash during extended closures. Online and mobile banking services are also available for transactions like checking balances or making digital payments, but the actual processing of interbank transfers might be delayed until the next working day.

Where can I find the official and most up-to-date list of bank holidays for India?

For the most accurate and current information, you should always consult the official website of the Reserve Bank of India (RBI) for national holidays. For state-specific holidays, refer to the official government websites of the respective Indian states, or the official websites of major Indian banks closer to February 2026.

Do Indian bank holidays affect the stock markets (NSE/BSE)?

Yes, generally the Indian stock exchanges, the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), observe the same public holidays as banks. If banks are closed for a public holiday, the stock markets will also likely be closed.