Your Essential Guide to February 2026 US Bank Holidays: Don’t Get Caught Off Guard!

Alright, let’s cut straight to it. You’re here because you need to know about bank holidays in February 2026 for your financial planning, and you want the real story, not a list of obscure national ‘days’ that won’t actually close your bank. I get it. Your time is valuable, and knowing when your money moves – or doesn’t – is critical.

Table of Contents

- Your Essential Guide to February 2026 US Bank Holidays: Don’t Get Caught Off Guard!

- February 2026 US Bank Holiday: The Quick Answer You Need

- Presidents’ Day 2026: More Than Just a Day Off (Observed February 16th)

- The History and Significance of Presidents’ Day

- How Federal and Banking Services are Affected

- Presidents’ Day Falling on a Monday: What Does This Mean?

- Federal Holidays vs. Bank Holidays: A Crucial Distinction for Your Wallet

- Your Banking Strategy for February 2026 Holidays

- What to Expect: Bank Branch Closures and Limited Services

- Your Go-To Options: Online Banking, Mobile Apps, and ATMs

- Smart Planning: Ensuring Your Payments and Transactions Go Smoothly

- February’s Other Observances: Not Bank Holidays (Don’t Get Confused!)

- Beyond February 2026: Preparing for Future Bank Holidays

- Conclusion: Be Prepared, Stay Ahead

February 2026 in the United States features one major federal bank holiday that will impact banking services across the country. Understanding this holiday, how it affects transactions, and how to plan around it is key to avoiding financial headaches. Forget the fluff about groundhogs or specific potato dishes; let’s focus on what truly matters for your wallet.

This comprehensive guide will give you the definitive answer for February 2026, explain the holiday’s significance, clarify the difference between federal and bank holidays, and provide you with actionable strategies to navigate bank closures seamlessly. By the time you’re done reading, you’ll be a pro at planning your February finances.

February 2026 US Bank Holiday: The Quick Answer You Need

For February 2026, there is one primary federal holiday observed by banks across the United States. This means most brick-and-mortar bank branches, credit unions, and federal institutions will be closed, and certain financial transactions like check clearing or ACH transfers may be delayed until the next business day.

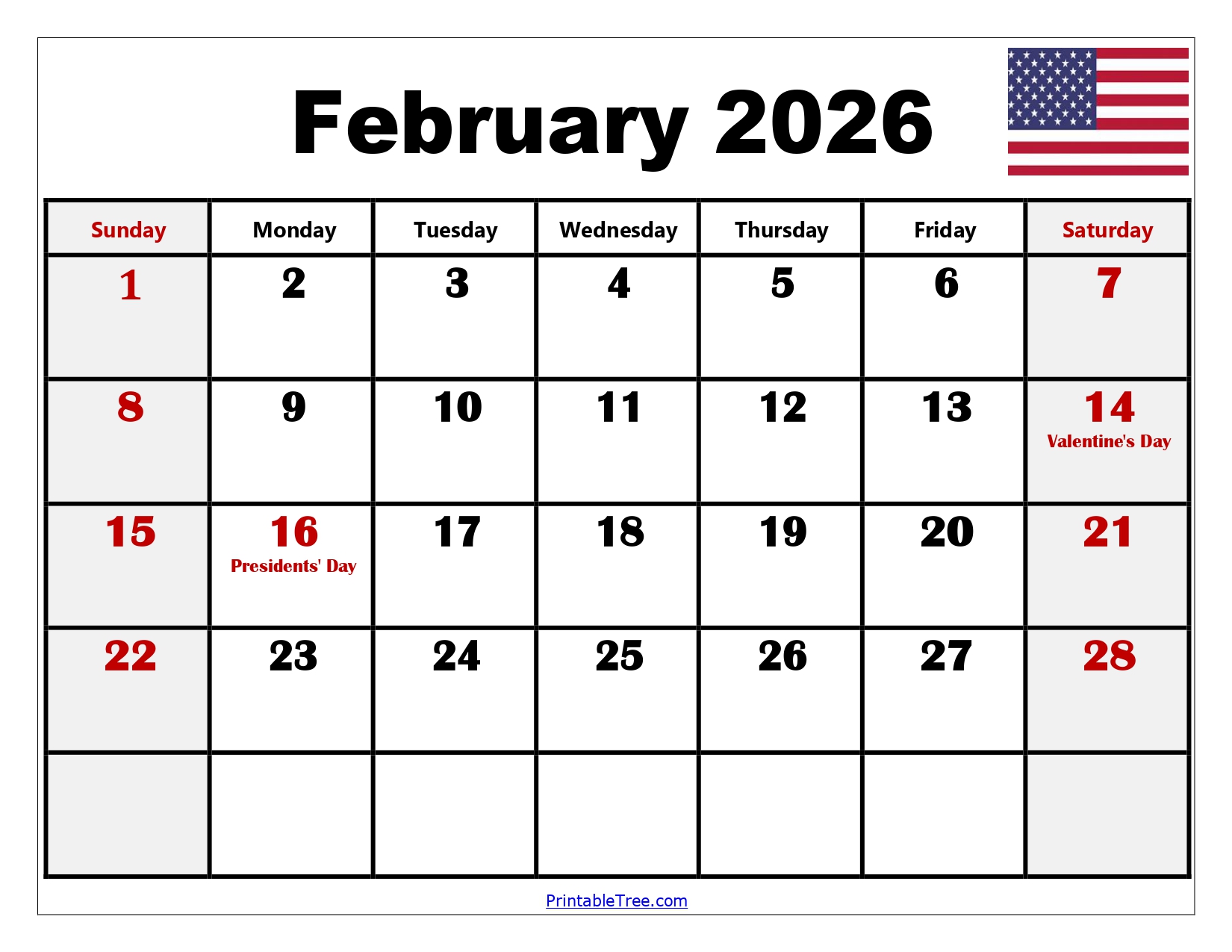

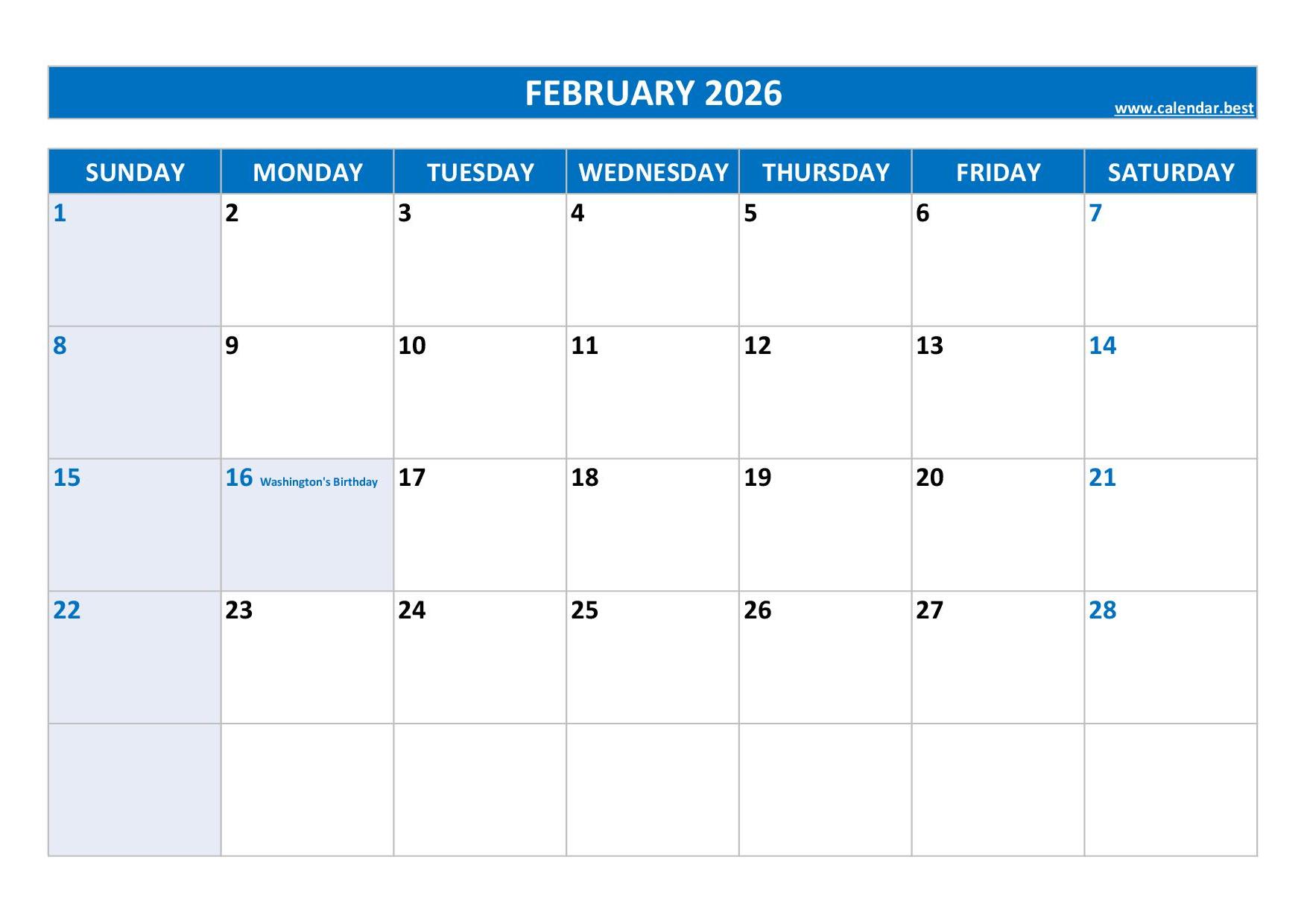

Here’s the essential information at a glance:

| Date | Day of Week | Holiday Name | Impact on Banks |

|---|---|---|---|

| February 16, 2026 | Monday | Presidents’ Day (Washington’s Birthday) | Most banks, credit unions, and federal institutions closed. |

That’s it. One day. No surprises if you’re prepared. Now, let’s dive deeper into what this means for you and your money.

Presidents’ Day 2026: More Than Just a Day Off (Observed February 16th)

Presidents’ Day is a significant observance in the United States, offering a moment to reflect on the nation’s leadership and history. While it’s officially Washington’s Birthday, it’s commonly known and celebrated as Presidents’ Day, honoring all U.S. presidents.

The History and Significance of Presidents’ Day

Originally, this holiday was established in 1879 to celebrate George Washington’s birthday, which falls on February 22nd. It was the first federal holiday to honor an American citizen. Over time, particularly after the Uniform Monday Holiday Act of 1971, which shifted several holidays to Mondays to create three-day weekends, the holiday’s interpretation broadened.

Today, while still legally Washington’s Birthday, it’s widely observed as Presidents’ Day to commemorate all past presidents, especially Abraham Lincoln, whose birthday is February 12th. This collective observance typically falls on the third Monday in February, which in 2026, is February 16th.

For many, it’s a day for retail sales, a long weekend getaway, or simply a day off work or school. But for financial institutions, it’s a day of closure, mirroring the federal government’s schedule.

How Federal and Banking Services are Affected

When Presidents’ Day rolls around, you can expect a widespread shutdown of government-related services and most banking operations:

- Federal Reserve Banks: All Federal Reserve banks and branches will be closed. This is crucial because the Fed facilitates the transfer of funds between banks, meaning interbank transactions are largely halted.

- Post Offices: The United States Postal Service (USPS) does not deliver mail on federal holidays, and post office branches are closed. If you’re expecting important documents or sending payments via mail, factor in this delay.

- Government Offices: Federal, state, and many local government offices will be closed. This includes DMV branches, courthouses, and administrative buildings.

- Banks and Credit Unions: The vast majority of commercial banks and credit unions will close their physical branches. While online services will remain available (more on that later), any transaction requiring human intervention or interbank processing will be on hold.

Understanding these closures is paramount for managing your finances, especially if you have time-sensitive payments or transactions.

Presidents’ Day Falling on a Monday: What Does This Mean?

As per the Uniform Monday Holiday Act, Presidents’ Day always lands on a Monday. In 2026, February 16th is a Monday. This means you get a lovely three-day weekend (February 14-16) to enjoy, but it also means an extended break for financial processing.

For you, this generally means:

- Delayed Fund Availability: If you deposit a check on Friday, February 13th, the funds might not process until Tuesday, February 17th, or even Wednesday, February 18th, depending on your bank’s specific policies and the type of check.

- Payment Processing: Any automatic bill payments, direct deposits, or wire transfers scheduled for February 16th will likely be processed on the next business day, February 17th.

Knowing this in advance allows you to adjust your schedule, make deposits early, or plan for any payments to clear after the holiday.

Federal Holidays vs. Bank Holidays: A Crucial Distinction for Your Wallet

You might hear the terms ‘federal holiday’ and ‘bank holiday’ used interchangeably, and often, they align perfectly. However, there’s a subtle but important distinction that’s worth understanding, especially when it comes to your money.

A federal holiday is one recognized by the U.S. government, meaning non-essential federal employees are excused from work, and federal offices are closed. These holidays are established by Congress. The Federal Reserve System, which is the central bank of the U.S., also observes these federal holidays.

A bank holiday, on the other hand, refers to days when banks and financial institutions close for business. While most commercial banks and credit unions choose to follow the Federal Reserve’s holiday schedule, they are not *legally required to close their doors on every federal holiday. However, due to the critical role the Federal Reserve plays in clearing transactions (like checks, ACH payments, and wire transfers), most banks find it impractical to remain fully operational when the Fed’s systems are shut down.

Think of it this way: The Federal Reserve is the backbone of the banking system. When the backbone takes a holiday, the whole body slows down. So, for all practical purposes, when the Federal Reserve observes a holiday, you can consider it a bank holiday for most financial institutions.

Why does this distinction matter for you?

- Transaction Processing: Even if a small, local credit union decided to open its lobby on Presidents’ Day, any transactions requiring interbank communication (like a direct deposit from your employer, or a payment to a utility company) would still be delayed because the Federal Reserve’s systems are closed.

- Consistency: The good news is that for major holidays like Presidents’ Day, you can almost always rely on your bank being closed, providing a consistent expectation across the industry.

It’s always wise to check your specific bank’s holiday schedule, especially for less common or state-specific holidays, but for federal observances like February 16, 2026, expect widespread closures.

Your Banking Strategy for February 2026 Holidays

Knowing about the Presidents’ Day closure is the first step; the next is creating a simple plan to ensure your financial life continues without a hitch. Nobody wants unexpected late fees or missed payments because of a holiday.

What to Expect: Bank Branch Closures and Limited Services

On Monday, February 16, 2026, anticipate the following:

- Physical Branches Closed: Nearly all bank and credit union lobbies will be shut. Don’t plan on visiting a teller or loan officer.

- No Over-the-Counter Transactions: You won’t be able to cash checks, make large deposits, or conduct other in-person services.

- Delayed Processing: As mentioned, checks deposited on the preceding Friday, or electronic transfers scheduled for the holiday, will likely not begin processing until the next business day (Tuesday, February 17th). This can impact direct deposits, bill pay, and person-to-person transfers.

- Customer Service: While some banks might have limited phone or chat customer service available, expect longer wait times or reduced capabilities, as many departments will be off.

The key here is that any service requiring a human touch or the movement of money between different financial institutions will be paused.

Your Go-To Options: Online Banking, Mobile Apps, and ATMs

The good news is that modern banking provides plenty of ways to manage your money even when the physical branches are closed. These digital tools are your best friends on a bank holiday:

- ATMs (Automated Teller Machines): Still fully operational 24/7. You can withdraw cash, deposit cash or checks (though check deposits will process on the next business day), and check your balance.

- Online Banking Portals: Log in via your bank’s website. You can view your account balances, transfer funds between your own accounts at the same bank, pay bills (if scheduled in advance), and access e-statements.

- Mobile Banking Apps: Most banks offer robust mobile apps that replicate much of the online banking functionality, often with added features like mobile check deposit (again, processed on the next business day).

- Bank-to-Bank Transfers (Internal): Transfers between accounts at the same financial institution often process immediately, even on holidays. However, transfers to accounts at other* banks will be delayed.

These tools empower you to handle most routine financial tasks without needing a bank to be open. Just be mindful of processing times for transactions that involve external parties.

Smart Planning: Ensuring Your Payments and Transactions Go Smoothly

A little foresight goes a long way when a bank holiday is approaching. Here are my top tips for smooth sailing:

- Schedule Payments Early: If you have bills due around February 16th, schedule them to be paid a day or two in advance. Don’t wait until the last minute. Remember, electronic payments might take an extra day to clear.

- Anticipate Direct Deposit Delays: If your paycheck typically hits your account on a Monday, and that Monday is Presidents’ Day, your employer might process it early (on the preceding Friday) or it might be delayed until Tuesday. Check with your employer’s payroll department if you’re unsure.

- Plan Cash Withdrawals: If you need cash for the long weekend, hit the ATM before Presidents’ Day. While ATMs are always available, you don’t want to find yourself in a situation where you need a large amount and a branch isn’t open.

- Check Transaction Processing Times: If you’re initiating a transfer or payment on Friday, February 13th, be aware that it might not clear until Tuesday, February 17th. Factor in these potential delays for critical transactions.

- Review Your Bank’s Specific Schedule: While federal holidays are generally observed, it never hurts to quickly check your bank’s website for their specific holiday operating hours or announcements.

By taking a few minutes to plan, you can enjoy your Presidents’ Day weekend without any financial worries.

February’s Other Observances: Not Bank Holidays (Don’t Get Confused!)

February is a month packed with various observances, national days, and cultural celebrations. While many of these are fun, interesting, or culturally significant, it’s absolutely crucial to distinguish them from federal bank holidays. None of the following will typically impact bank operating hours or transaction processing:

- Groundhog Day (February 2): A fun tradition where a groundhog predicts the arrival of spring. Banks are fully open.

- Black History Month (All of February): An important annual observance celebrating the achievements and contributions of African Americans. Bank services are normal.

- Valentine’s Day (February 14): The day for celebrating love and affection. Your bank will be open for you to buy that special someone a gift (or send money for it!).

- Ash Wednesday (February 18, 2026): Marks the beginning of Lent for many Christians. While a significant religious observance, it is not a bank holiday.

- National ‘Fun’ Days: You might see calendars listing things like ‘National Tater Tot Day’ or ‘National Get Up Day.’ These are purely ceremonial and have no bearing on federal or bank operations.

The SERP results for this keyword often include these non-bank holidays, which can be confusing. My advice? When in doubt, default to the official federal holiday schedule. If it’s not on that list, your bank is almost certainly open for regular business.

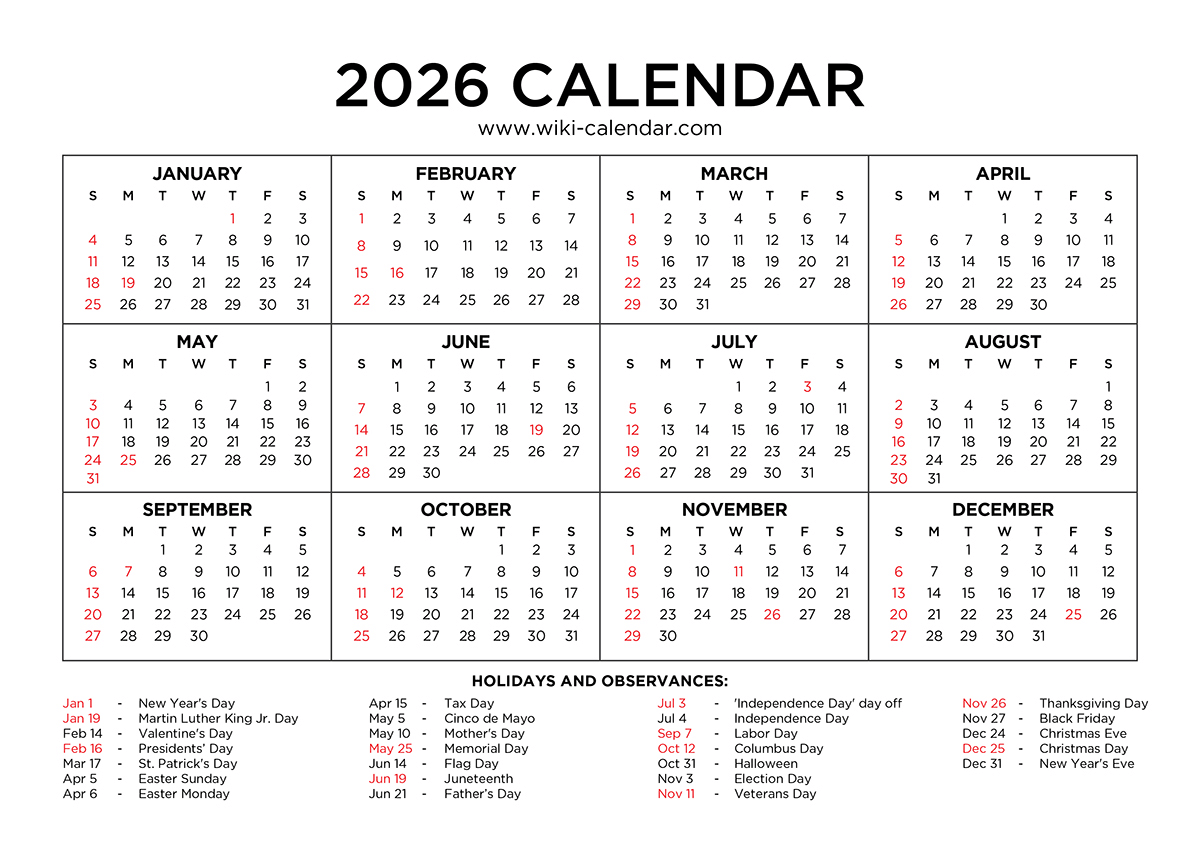

Beyond February 2026: Preparing for Future Bank Holidays

The principles we’ve discussed for February 2026 apply to all future bank holidays. Understanding the rhythm of federal and bank closures empowers you to stay on top of your financial game throughout the year. Always remember:

- Federal Holidays are Key: These are the days to watch for widespread bank closures.

- Digital is Your Friend: Leverage online banking, mobile apps, and ATMs for convenience.

- Plan Ahead: Proactive scheduling of payments and transfers eliminates stress.

Make it a habit to glance at the upcoming federal holiday schedule at the beginning of each year. A quick check can save you from potential headaches and ensure your financial obligations are always met on time.

Conclusion: Be Prepared, Stay Ahead

Navigating February 2026 bank holidays in the US boils down to one key date: Monday, February 16, 2026, for Presidents’ Day. While the month is dotted with other observances, this is the only one that will impact your ability to conduct in-person banking or affect the processing times of critical transactions.

By understanding why banks close, planning your financial tasks in advance, and utilizing the robust digital banking tools at your disposal, you can ensure a smooth and stress-free February. Don’t let a bank holiday catch you off guard – stay informed, stay prepared, and keep your finances moving forward.

Frequently Asked Questions

What is the only federal bank holiday in February 2026 for the USA?

The only federal bank holiday in February 2026 for the USA is Presidents’ Day (Washington’s Birthday), observed on Monday, February 16, 2026. Most banks and federal institutions will be closed on this day.

Will my bank be open on Presidents’ Day in February 2026?

No, most physical bank branches and credit unions will be closed on Presidents’ Day, February 16, 2026. This is because the Federal Reserve System, which facilitates interbank transactions, also observes this federal holiday.

Can I still access my money or pay bills on a bank holiday?

Yes, you can still access your money through ATMs for cash withdrawals and deposits (though check deposits will process on the next business day). Online banking portals and mobile apps remain fully functional for checking balances, transferring funds between your own accounts at the same bank, and scheduling future bill payments. However, transactions involving other banks will be delayed.

What happens if a direct deposit or automatic payment is scheduled for February 16, 2026?

Direct deposits and automatic payments scheduled for February 16, 2026, will likely be processed on the next business day, Tuesday, February 17, 2026. It’s advisable to schedule critical payments a day or two in advance of the holiday to avoid any late fees or inconveniences.

Are other February observances like Valentine’s Day or Groundhog Day considered bank holidays?

No, other observances in February, such as Groundhog Day (February 2), Valentine’s Day (February 14), or Ash Wednesday (February 18, 2026), are not federal bank holidays. Banks will operate under normal business hours on these days and will not be impacted by these observances.

Why is it important to know about bank holidays in advance?

Knowing about bank holidays in advance is crucial for effective financial planning. It helps you avoid potential delays in fund availability, ensures timely bill payments, allows for proactive cash withdrawals, and helps you navigate any interruptions in transaction processing, preventing unforeseen financial issues.