US Bank Holidays February 2026: Your Essential Guide to Presidents’ Day Banking

Wondering if you can pop into your bank this February 2026? Or perhaps you’re planning payroll, a wire transfer, or just need to know if that direct deposit will hit on time. You’re in the right place. February, while short, often holds one significant day that impacts your banking plans: Presidents’ Day. And in 2026, it’s no different.

Table of Contents

- US Bank Holidays February 2026: Your Essential Guide to Presidents’ Day Banking

- The Definitive Answer: February 2026 US Bank Holidays

- All Federal Bank Holidays in 2026: The Full Calendar

- Understanding Presidents’ Day: What it Means for You

- Federal Holiday vs. Bank Holiday: Is There a Difference?

- Navigating Bank Closures: Practical Tips for February 16th and Beyond

- 1. Plan Ahead for Critical Transactions

- 2. Understand ACH and Wire Transfer Delays

- 3. Leverage Online Banking and Mobile Apps

- 4. Use ATMs for Cash Needs

- 5. Payroll and Business Considerations

- 6. Monitor Your Account

- The Federal Reserve’s Role in Holiday Observances

- State-Specific Holidays: A Local Nuance (and why February 2026 is generally uniform)

- Final Thoughts: Bank Smart, Not Hard, in February 2026

Let’s cut straight to it: for February 2026, there is one federal bank holiday that will see most US banks closed. That day is:

The Definitive Answer: February 2026 US Bank Holidays

The only federal bank holiday observed in February 2026 is Presidents’ Day, officially known as Washington’s Birthday.

| Holiday Name | Date in February 2026 | Day of the Week | Observed By |

|---|---|---|---|

| Presidents’ Day (Washington’s Birthday) | February 16, 2026 | Monday | Federal Government, Most Banks, US Post Office |

This means if you have in-person banking needs, plan to conduct transactions that require human intervention, or are waiting on a critical payment, you’ll need to account for this closure. Keep reading for a complete list of 2026 bank holidays and crucial tips for managing your finances around them.

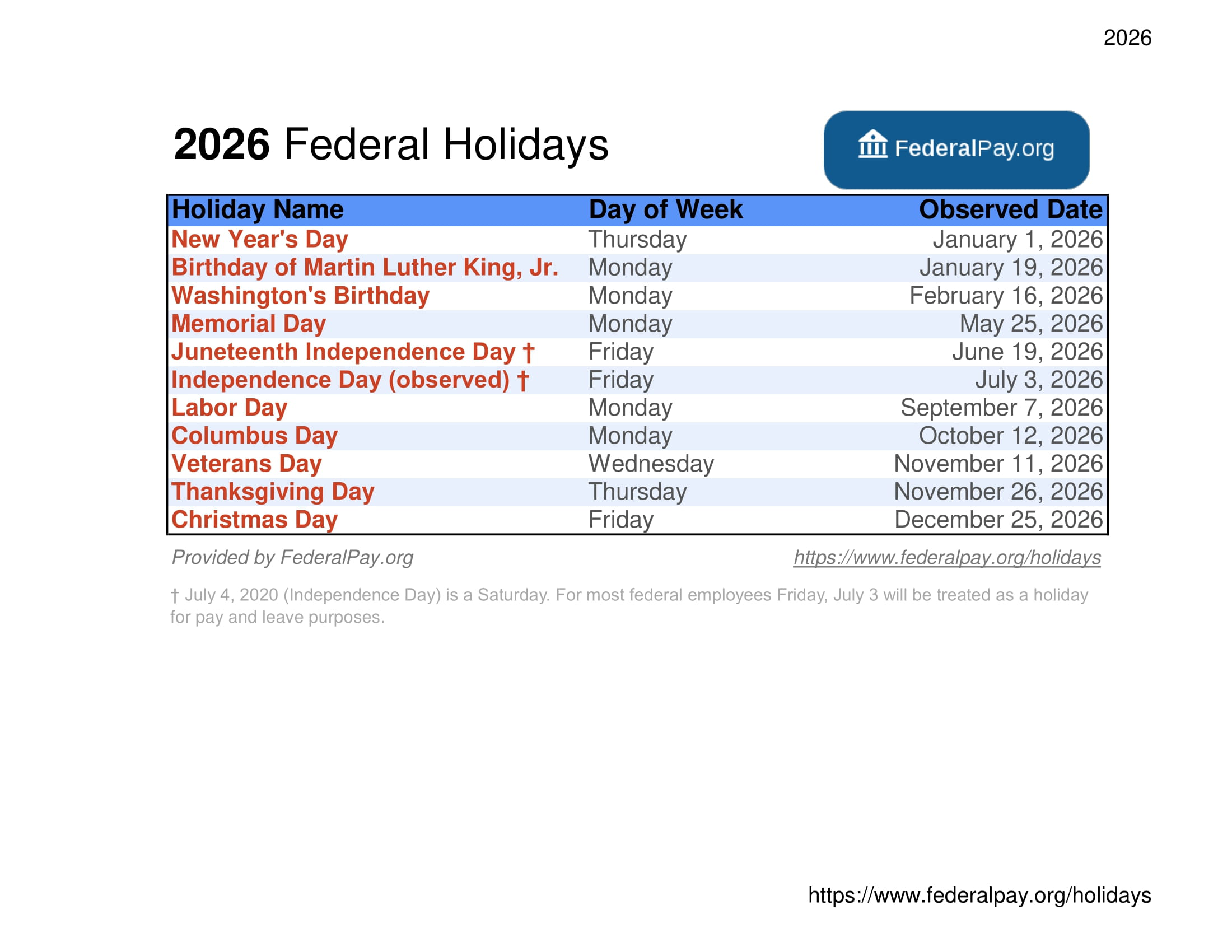

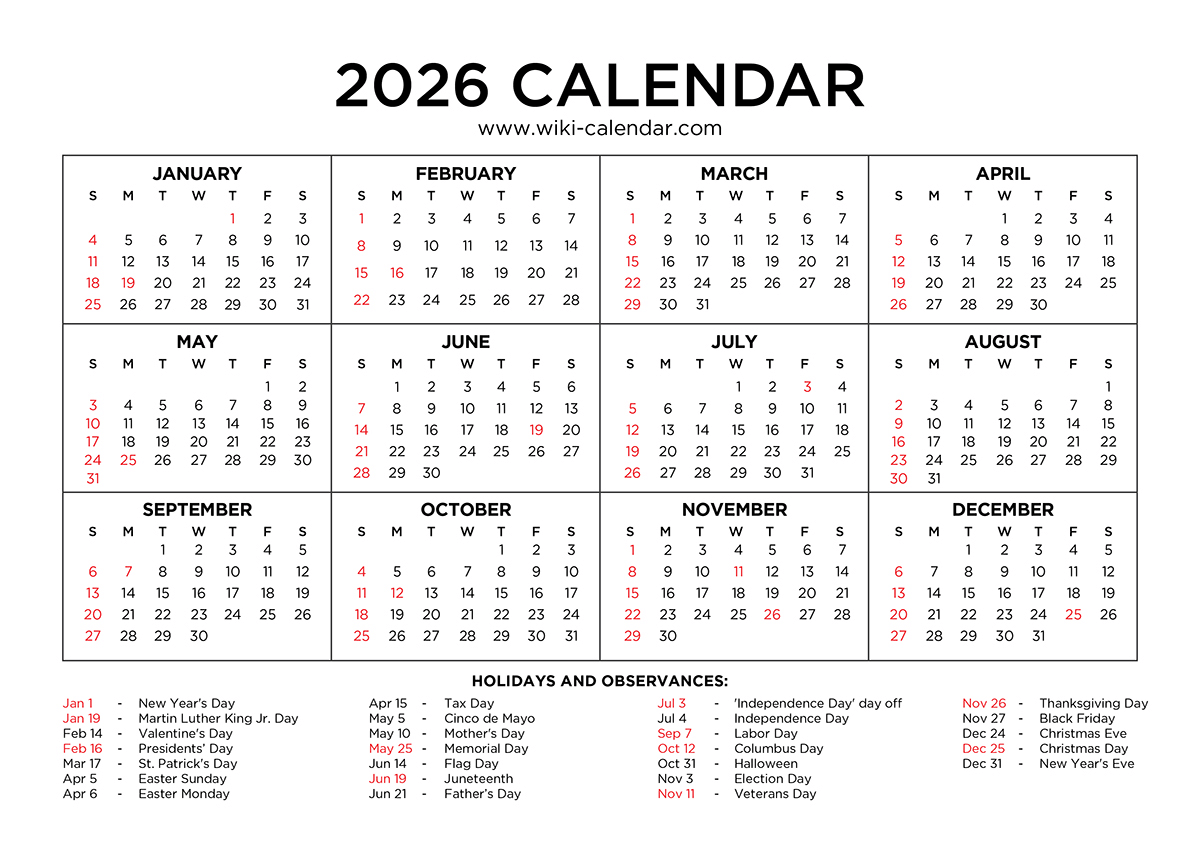

All Federal Bank Holidays in 2026: The Full Calendar

While your immediate concern might be February, it’s incredibly helpful to have the full year’s federal bank holiday schedule at your fingertips. These are the days when the Federal Reserve System and most banks will be closed, impacting everything from loan processing to check clearing.

| Date in 2026 | Day of the Week | Holiday Name |

|---|---|---|

| January 1 | Thursday | New Year’s Day |

| January 19 | Monday | Birthday of Martin Luther King, Jr. |

| February 16 | Monday | Washington’s Birthday (Presidents’ Day) |

| May 25 | Monday | Memorial Day |

| June 19 | Friday | Juneteenth National Independence Day |

| July 3 | Friday | Independence Day (Observed – July 4th is Saturday) |

| September 7 | Monday | Labor Day |

| October 12 | Monday | Columbus Day / Indigenous Peoples’ Day |

| November 11 | Wednesday | Veterans Day |

| November 26 | Thursday | Thanksgiving Day |

| December 25 | Friday | Christmas Day |

It’s worth noting that when a federal holiday falls on a weekend, it’s typically observed on the preceding Friday or the following Monday. For 2026, Independence Day (July 4th) falls on a Saturday, so it will be observed on Friday, July 3rd.

Understanding Presidents’ Day: What it Means for You

Presidents’ Day, observed on the third Monday in February, commemorates the birthdays of all U.S. presidents, though it originated as a celebration of George Washington’s birthday. For 2026, that falls on Monday, February 16th.

So, beyond the chance for a long weekend (if you’re lucky enough to have it off!), what does this mean practically?

- Government Offices: Most non-essential federal government offices, including the US Post Office, will be closed.

- Schools: Many schools and universities also observe Presidents’ Day, leading to closures or modified schedules.

- Retail: Most retail businesses, restaurants, and private sector companies remain open, often with special sales events. Don’t expect your favorite store to be shut down.

- Financial Markets: The New York Stock Exchange (NYSE) and NASDAQ typically close on Presidents’ Day.

The key takeaway for you, the everyday consumer, is that if an institution relies on the federal calendar or the Federal Reserve for its operations, it’s highly likely to be closed. This is particularly true for banks.

Federal Holiday vs. Bank Holiday: Is There a Difference?

This is a common point of confusion, and frankly, it’s an important distinction that many online resources gloss over. While often used interchangeably, there’s a subtle but significant difference that can impact your financial planning.

A federal holiday is designated by the U.S. government, primarily for federal employees. On these days, non-essential federal government offices are closed, and federal workers are paid for the holiday.

A bank holiday, on the other hand, is when the Federal Reserve System observes a holiday, leading to the closure of most financial institutions. Because the Federal Reserve processes most interbank transfers (like ACH and wire transfers), when they close, the entire banking system effectively shuts down for certain operations.

Here’s where the nuance comes in:

- Federal Reserve Mandate: All federally regulated banks generally follow the Federal Reserve’s holiday schedule. This means your large national banks (like Chase, Bank of America, Wells Fargo) will almost certainly be closed on February 16, 2026.

- Individual Bank Discretion: Some smaller community banks or credit unions *might choose to open on certain federal holidays, especially if they don’t rely heavily on Federal Reserve services for day-to-day retail transactions. However, even if their lobby is open, complex transactions might still be delayed because the underlying financial infrastructure (the Federal Reserve) is closed. Online-only banks often operate 24/7 for basic services but will still have delays for processing that relies on the federal banking system.

Always check with your specific bank for their holiday schedule, especially if you deal with a local credit union or a smaller institution. Don’t assume!

| Feature | Federal Holiday | Bank Holiday |

|---|---|---|

| Primary Purpose | Designated for federal employees, government offices. | When the Federal Reserve System closes, impacting interbank transactions. |

| Impact on Banks | Most banks observe, but some smaller ones might remain open for limited services. | Nearly all federally regulated banks will be closed for lobby services and processing. |

| Processing Delays | High likelihood of delays for transactions relying on the Federal Reserve. | Guaranteed delays for ACH, wire transfers, check clearing. |

| ATM & Online Banking | Generally available, but transactions may not process until the next business day. | Generally available, but transactions will not process until the next business day. |

Navigating Bank Closures: Practical Tips for February 16th and Beyond

Understanding when banks are closed is one thing, but knowing how to manage your money around those closures is where the real value lies. Here are some actionable tips to ensure your financial life runs smoothly, especially around Presidents’ Day 2026:

1. Plan Ahead for Critical Transactions

If you need to send a wire transfer, make a large deposit that needs immediate clearance, or process a specific loan payment, do it before February 16th. A transaction initiated on Friday, February 13th, will likely process by the end of that day. If you wait until Monday, February 16th, it won’t even begin processing until Tuesday, February 17th. That’s a significant delay.

2. Understand ACH and Wire Transfer Delays

- ACH (Automated Clearing House) Transfers: These include direct deposits (like paychecks), automatic bill payments, and electronic fund transfers between banks. They are processed in batches by the Federal Reserve. On a bank holiday, no processing occurs. So, if your paycheck is usually scheduled for Monday, February 16th, your employer may have adjusted it to deposit on the preceding Friday (February 13th) or the following Tuesday (February 17th). Always check with your payroll department.

- Wire Transfers: These are typically faster than ACH but still rely on the Federal Reserve’s operating hours. A wire transfer initiated on a bank holiday will sit pending until the next business day.

3. Leverage Online Banking and Mobile Apps

The beauty of modern banking is that you’re not entirely cut off on a holiday. Your bank’s online portal and mobile app will still allow you to:

- Check account balances.

- Transfer money between your own accounts at the same institution.

- Pay bills (though the payment might not be processed by the recipient until the next business day).

- Deposit checks remotely using mobile deposit (funds will still be subject to standard hold times and won’t process until the next business day).

These tools are incredibly useful for maintaining visibility and control over your finances even when branches are closed.

4. Use ATMs for Cash Needs

ATMs operate 24/7, regardless of bank holidays. If you need cash, an ATM is your go-to. Just remember that deposits made via ATM on a holiday won’t begin processing until the next business day.

5. Payroll and Business Considerations

For small business owners, payroll is a critical component affected by bank holidays. If your payroll date falls on February 16, 2026, you’ll need to submit it earlier to ensure employees are paid on time. Most payroll services will remind you of these adjusted deadlines, but it’s your responsibility to be aware and act proactively.

6. Monitor Your Account

Even with careful planning, it’s always wise to monitor your accounts closely around holidays. Check to ensure expected deposits arrive and that payments you’ve scheduled go out as intended. If something seems off, contact your bank on the next business day.

The Federal Reserve’s Role in Holiday Observances

Why do most banks follow the Federal Reserve’s lead? It’s simple: the Federal Reserve Banks operate the nation’s payment systems. This includes the processing of checks, electronic funds transfers (ACH), and wire transfers. When the Federal Reserve Banks are closed, these critical systems are effectively paused.

Therefore, even if a bank wanted* to open its doors for full service, its ability to clear checks, process electronic payments, or facilitate transfers to other banks would be severely limited. It’s not just about a bank choosing to give its employees a day off; it’s about the fundamental infrastructure of the banking system being offline.

This is why understanding the federal holiday schedule is paramount for anyone involved in finance, from individual consumers to large corporations. The Federal Reserve’s website (frbservices.org) is an excellent primary source for official schedules, though this guide aims to make that information more accessible and actionable for you.

State-Specific Holidays: A Local Nuance (and why February 2026 is generally uniform)

While this guide focuses on federal bank holidays, it’s worth a quick mention that some states observe their own unique holidays. For example, some states recognize specific historical figures or events not celebrated federally. Lincoln’s Birthday (February 12th) is an example often cited as a state holiday in some jurisdictions, though it’s not a federal bank holiday.

However, these state-specific holidays typically do not impact the broader US banking system or cause widespread bank closures like a federal holiday. A local bank might choose to close, but the Federal Reserve will still be operating, meaning interbank transfers largely proceed as usual.

For February 2026, the key holiday impacting banking across the nation remains Presidents’ Day (Washington’s Birthday) on the 16th. Any other state or local observances would be highly localized and would not typically halt federal banking operations.

So, you can generally rest assured that if your bank isn’t operating on February 16, 2026, it’s because of the federal observance of Presidents’ Day, not a niche state holiday.

Final Thoughts: Bank Smart, Not Hard, in February 2026

Knowing the US bank holiday schedule for February 2026, and indeed for the entire year, empowers you to make smarter financial decisions. Presidents’ Day, observed on Monday, February 16th, 2026, is a day when most banks will be closed, and critical financial processing will pause. By planning ahead, utilizing online tools, and understanding the ‘why’ behind these closures, you can ensure your money matters stay on track.